The technological revolution did not arrive with only development-driven initiatives but also brought sophistication to criminal activities. It can be said that technology has revolutionized the traditional way of criminality into a more worldly one called cybercrime, where one can be physically located in Ghana and commit a crime in another country or any part of the world. That is how complex cybercrime is and how it continuously evolves into a more complex enterprise. Though crime has existed since its creation, cybercrime is argued to be the brainchild of technology. Anyway, technology is not to blame for cybercrime, as the idea behind it was development-motivated, but people with criminal mindsets are equally motivated to utilize any means available to perpetrate their criminal activities, hence the emergence of cybercrime. The effect of cybercrime on businesses and the economy is highly multifaceted. The very effort of digitizing an economy also creates more avenues for cybercriminals, posing a huge problem for the economy it seeks to develop. A look at Ghana’s digitalization drive and the problems therein that could affect and thwart the whole economic development agenda.

The introduction of the paperless ports system means the import processes are now done via an online system that captures all relevant import information on a database called the ICUMS (Integrated Customs Management System). Traders can obtain required import licenses, permits, and certificates before the arrival of goods, as well as pay fees, among other things. Additionally, a risk clearance system is used to control transaction selectivity and allow automated customs release without scanning or physical inspection. This has created another avenue for cybercriminals to perpetrate their activities by hacking the system and altering import licenses, permits, and certificates to avoid paying the required fees. For instance, in April 2023, during an undercover investigation on stolen vehicles, a hacker told investigative journalist Mariana Van Zeller of the National Geographic Channel that he could hack into the system of the Customs Division to help the syndicate get away with paying the required import duties.

As a result of the widespread adoption of mobile money and other digital payment systems in Ghana, the Government introduced the Ghana.gov digital services and payments platform to allow Ghanaians to send money to various government ministries and organizations. This is meant to provide a single point of access for all government services provided by departments, ministries, and other organizations.

The Ghana PostGPS is a global addressing system that divides Ghana into grids of 5m x 5m squares and assigns each one a unique address, known as a digital address. With this system, every piece of land and property will get a permanent address. The system is location-based and is expected to enhance an effective means of providing an address to every location and place in the country, including undeveloped parcels of land, using an information technology application (app). The app generates a unique code for every property or location in Ghana with the use of Global Positioning System (GPS) technology (Bokpe, 2017).

Tiered License Categories, Merchant Account Categorization, and the GhQR. The Tiered License Category is a License Application Pack that provides various license categories for payment service providers. It is anticipated that it will provide various client groups in Ghana with cutting-edge digital banking services. Small and Medium Enterprises (SMEs) have the chance to obtain merchant accounts that are suited to their needs thanks to the Bank of Ghana’s three-tiered Merchant Account Categorization system. A countrywide QR code payment solution called GhQR has made merchant payments easier and cut down on the use of cash. Ghana’s financial institutions and payment service providers now have access to this integrated solution.

Mobile Money Interoperability (MMI) systems enable customers to make a transfer between two mobile money accounts held at different mobile money providers (MMP), for instance, Vodafone Cash and MTN Mobile Money, or AirtelTigo Cash and Vodafone Cash, or between an MMP and a bank. The service known as MMI enables quick and easy money transfers between mobile money wallets over different networks. It allows the transfer of funds from a wallet into a bank account and e-zwich cards, and from wallets and e-zwich cards to a bank account. The mobile money system is believed to be growing very fast, and so is mobile money fraud.

Regulatory sandbox by the Bank of Ghana is available to banks, specialized deposit-taking institutions, and payment service providers, including dedicated electronic money issuers, to provide a forum for financial sector innovators to communicate with the industry regulator to evaluate innovations in digital financial services while assisting in the expansion of the regulatory environment and expertise.

E-justice is where technology, information, and communications are used to improve access to justice and effective judicial actions. Requisitioning, ordering, and buying products and services online is known as electronic procurement, sometimes known as supplier exchange. It is a business-to-business process. E-procurement eliminates the need to manually carry out laborious, procurement-related tasks such as e-Auctions and e-Tenders, exchanging supplier contracts, and filling out supplier onboarding questionnaires. The process works by connecting various entities and processes through a centralized platform. One of the most crucial elements of e-procurement is vendor and supplier management. It involves both supplier relationship management and supplier information management (Awati, & Pratt, 2021).

As announced by the Bank of Ghana, it had partnered with Giesecke+Devrient to pilot a retail central bank digital currency in Ghana. The e-cedi is said to complement and serve as a digital alternative to physical cash. During its piloting, the e-CEDI was tested with banks, payment service providers, merchants, consumers, and other relevant stakeholders.

Through the creative use and application of information and communication technology, the national identification system, which is run by the National Identification Authority, aims to collect personal and biometric data, ensure the protection of enrollees’ privacy and personal information, and provide a complete value-added integrated multi-sectoral and multipurpose National Identity System to support Ghana’s social, economic, and political development.

The government of Ghana wants to digitize fiscal revenue collection, support a cashless society, and enhance online education delivery, according to the (International Trade Administration (ITA, 2022). It also wants to invest in the national fiber network backbone to increase and improve internet connections. Another top objective is to encourage Ghanaian tech entrepreneurs in their efforts to establish tech hubs and export IT-enabled services like business process outsourcing (BPO).

Most recently, the introduction of E-VAT by the Ghana Revenue Authority to digitize the collection of value Added Tax, which is an electronic means of issuing value Added Tax receipts or an electronic invoicing system for VAT-registered businesses, This, according to the Ghana Revenue Authority, is to enhance record keeping, otherwise known as bookkeeping, reduce the cost of compliance, ease filling, and simplify the VAT refund process.

These digitalization initiatives have invited more cybercriminals into that space and created a herculean task for the Ghana Police Service, considering how porous cyberspace is, especially in Ghana. The fact that digitalization creates avenues for cybercriminals to operate cannot be used as a justification to downplay the many benefits derived from digitalization. It is of note that digitizing an economy or a country creates cyber-related problems in as much as it resolves another problem. It increases cybercrime cases, especially in any environment with porous cyberspace. The increase in cybercrime activities largely affects businesses and economies in multiple ways. The Ghana Police Service is very aware that the actual cost of cybercrime is really difficult to accurately assess and quantify due to the non-reportage of many cybercrime cases yet a fair argument on the effect of cybercrime on the economy can be made based on figures available, for instance.

The increasing incidence of cybercrime discourages foreign investors from establishing businesses in countries tagged as hubs for cybercrime activities. The negative image cybercrime hangs on a country goes a long way toward affecting the economy by preventing foreign investment, as every business thrives in a conducive and hygienic business environment that is extended to cyberspace, as most businesses are operating in that space. For instance, credit and payment systems, e-commerce, etc. The internet has become an essential environment for businesses, in an era where digitalization is on the ascendance; hence, any criminal activity that targets the internet, in this case, cybercrime, stifles business growth. Aside from discouraging investors, businesses will not be motivated to adopt technologies for innovation considering the huge threat of cybercrime.

According to the INTERPOL (International Police) Unit of the Ghana Police Service, a series of reports of cybercrimes, mostly cyber fraud, are received from member countries for investigation. Usually, victims in those countries had lost money to cybercriminals whose identities or locations had been traced to Ghana. Some of these cases include romance scams, gold scams, investment fraud, inheritance schemes, etc.

There are instances like email compromise, where victims (usually companies) in Ghana think they are dealing with their counterparts in other countries but will end up losing huge sums of money to these cyber criminals, who divert the funds to different bank accounts belonging to their criminal syndicate. Most of these perpetrators are usually traced to Ghana.

The financial losses due to cybercrime are very significant, and businesses also suffer other disastrous consequences as a result of the activities of cybercriminals. The consequences come in the form of damaging brand identity and reputation, damaging investor confidence, and a potential drop in the prices of shares. Businesses may also be sued for data breaches that may result in fines and penalties. Its effects on a country’s public health and national security cannot be overemphasized (Brush, Rosencrance, & Cobb, 2021). Similarly, Tunggal (2022) strongly believes cybercrime badly affects businesses, institutions, and governments through economic loss and reputational damage. Theft of intellectual property, business information, and trading interruptions cost a lot of money to fix, which results in a decline in consumer confidence, a loss of existing and potential consumers to rivals, and negative media attention. For instance, in May 2017, a cyberattack involving the “WannaCry” Ransomware affected many notable organizations globally. Experts argued that this attack is the world’s biggest single cyberattack incident, considering the damages caused and the number of countries affected. Nearly 200,000 computers and databases belonged to various organizations, and at least 150 different nations were impacted (Media Foundation for West Africa, 2017).

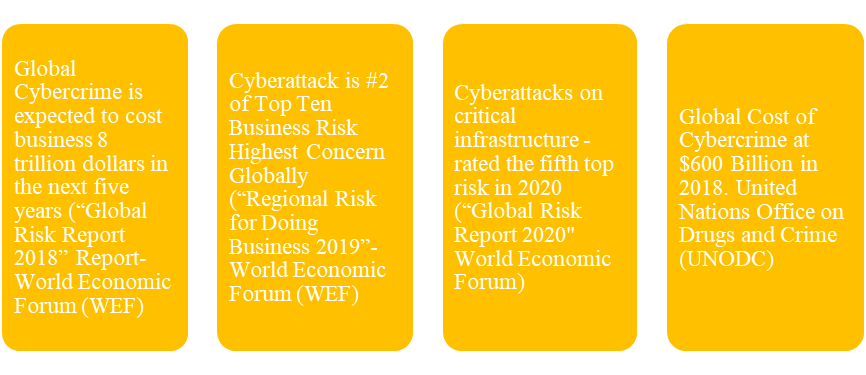

Figure 1: Global Cybercrime Trends and Reports

In the Ghanaian context, the issue of cybercrime continues to cause unending havoc and thwart the development of the country. A testimony to this is the recent incident when the Electricity Company of Ghana’s (ECG) prepaid software was reportedly hacked. This prevented customers from vending and purchasing prepaid for close to a week, and the attack on the electronic transmission system of the Ghana Electoral Commission during the 2016 election was reported by the Chairperson. The economic losses and damages that occurred during that period were difficult to quantify. According to the Media Foundation for West Africa (2017), Ghana has been blacklisted by many significant international e-commerce companies and online retailers, including Amazon, PayPal, and other online retail stores. Residents in Ghana are unable to purchase goods and services from some international online shops with their credit cards because of cyber fraud.

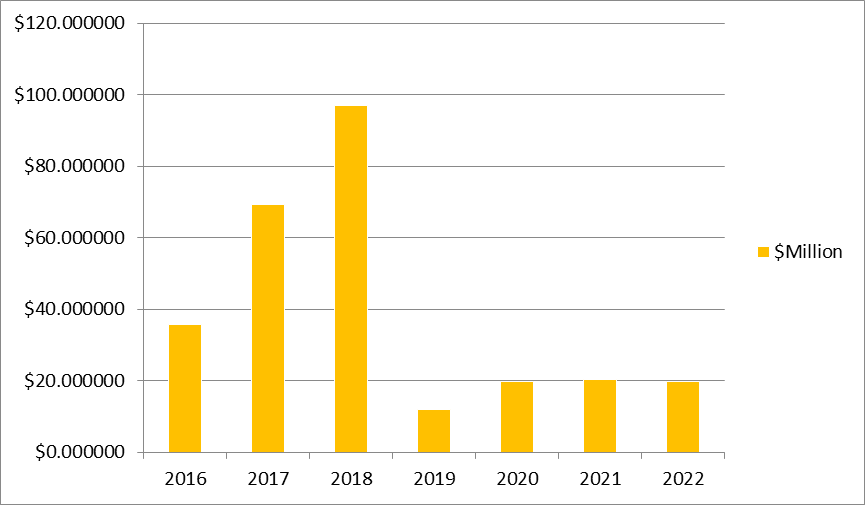

According to the former Director of the Cybercrime Unit at the CID, Dr. Gustav Yankson, cybercrime activities in Ghana, especially fraud alone, constituted 60 percent of crimes recorded daily, and the country lost 35 million dollars to fraud in 2016. In 2017, an amount of 69 million dollars was lost, while 97 million dollars were lost by August 2018 (Ghana News Agency, 2018). Giroud (2021) argued that the incidence of cybercrime is obstructing the development agenda of the country, as data from the E-Crime Bureau indicates an estimated cost of US$ 230 million to the country over the period from 2016 to August 2018. These statistics indicate the increasing incidence of cybercrime in Ghana, which corroborates the assertion that the lack of awareness of risks in the internet space, has contributed to the increase in cyberfraud cases in the country. It has emerged that a total of $19.8 million was lost by victims as a result of the activities of cyber fraudsters in the country in 2020, $20.3 million in 2021, and $19.7 million in 2022. Comparatively, in 2019, the total amount lost to cyber criminals was $11 million (Cybercrime Unit, Ghana Police Service, 2022).

Figure 2: Monies lost to cybercrime in Ghana from 2016–2022.

Source: The Cybercrime Unit of the Criminal Investigation Department, Ghana Police Service.

Figure 2 above gives a breakdown of monies lost to cybercrime from 2016 to 2022. The decrease in monies lost, as indicated in Figure 3, is a reflection of the efforts of the Ghana Police Service and other institutions created to intervene in protecting cyberspace, but that is not to say the cyberspace has been fully secured. The constant increase and decrease in the monies lost to cybercrime in Ghana from 2016 to 2022 justify the need to intensify the fight against cybercrime and consolidate the gains made during the period that resulted in a decrease in monies lost. The various institutions, including the Ghana Police Service, should be recommended for tremendous work, looking at the amount lost to cybercrime in just three years (2016–2018) which is over 201 million dollars, as against four years (2019–2022) amounting to about 70.8 million dollars. This indicates how well the institutions created to curb the menace are working to make cybercrime unattractive.

This demonstrates how seriously the nation must take cyber security to preserve its economic prospects and help consolidate the digitalization efforts made so far. The negative implication of cybercrime on businesses and the threats it poses to national security call for urgent action to secure cyberspace.

Author’s Profile: He is an investigator and Cybersecurity Practitioner. [PhD (Candidate), P-G Law (UK), MSc, BSc, Dip.] Ghana, UK. The author’s research interests are in IT, Cybersecurity, Law, Artificial Intelligence, Security, and Criminal Psychology.

Recommended Citation: Abdul-Salam, S. (2023). Ghana’s Digitalization Drive and the Effects Of Cybercrime On The Economy.

Please address all correspondence to: Abdul-Salam Shaibu by Phone: at (+233) 026 530 8783 and by email on shaibubaba80@gmail.com